Investment

Why Invest?

Investing in UTOS allows you to access affordable investment opportunities regardless of your income earning status. Whether you are a Samoan residing locally or abroad, investing a small amount regularly allows you to save for the future.

Your investments in UTOS will allow you to own shares in privately owned companies both locally and abroad and allows you to contribute to the development of Samoa through assisting with financing of government projects locally and abroad.

We encourage that you invest for the long term to maximise the benefits gained through your investment.

Where do we invest?

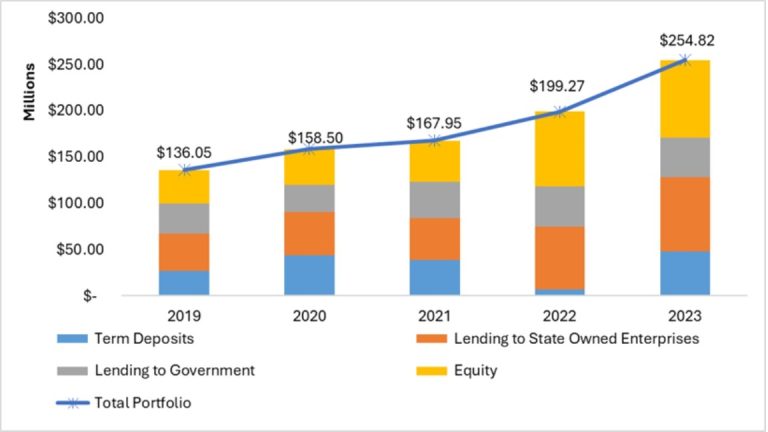

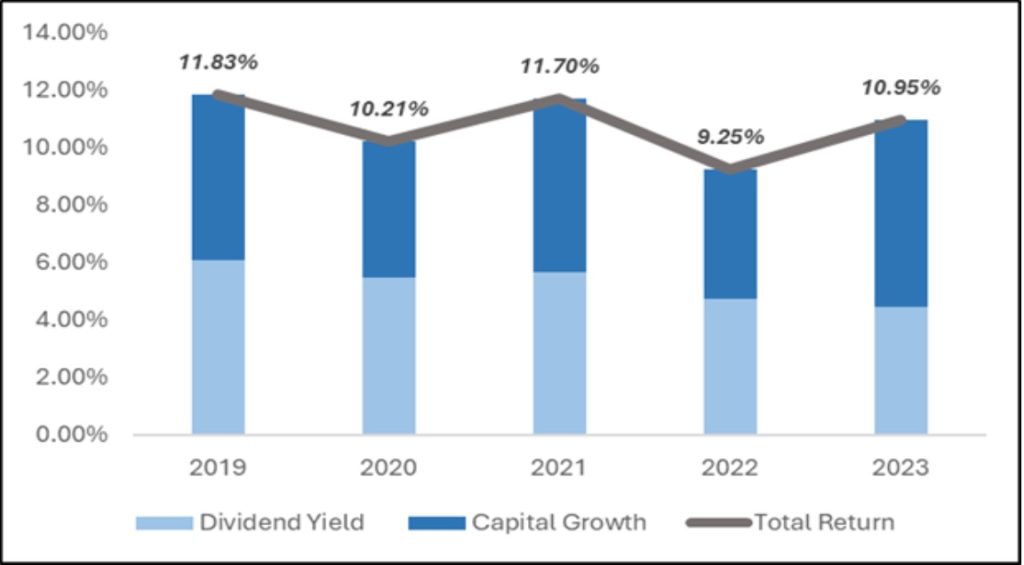

Your funds are invested in a diversified portfolio of assets. The 5-year asset allocation & total portfolio growth is represented by the below chart:

- Capital Equity Investments

- Listed Equities – Unit Trust of Fiji, BSP Financial Group(PNG & Australia), ATH Group (Fiji)

- Unlisted Equities – Vodafone Samoa, ATH International Ventures(Singapore), Samoa Submarine Cable Company

- Lending

- The Trust is only allowed to lend to State Owned Enterprises or directly to Government.

- These lending facilities are secured with an effective and enforceable Government Guarantee.

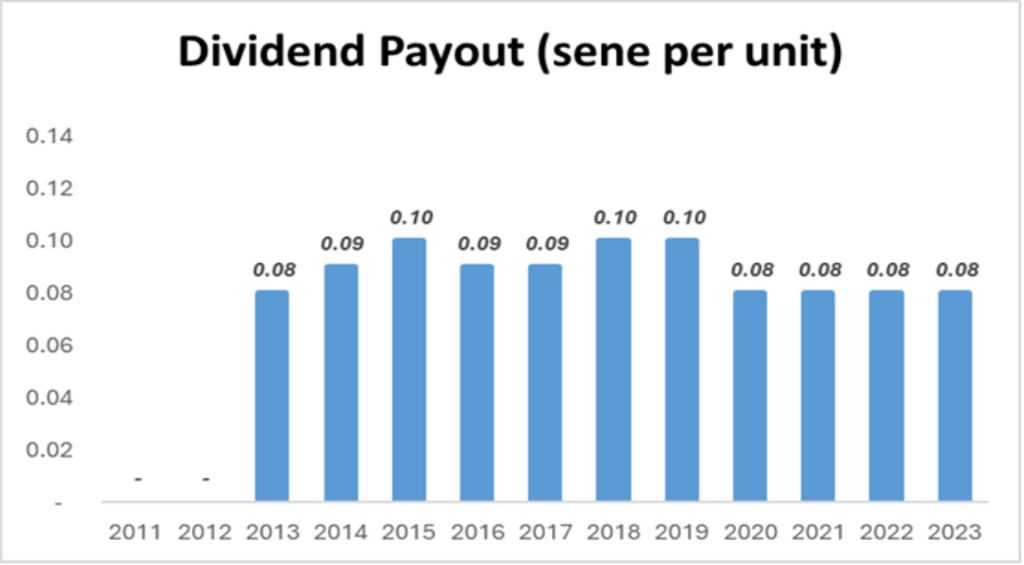

Dividend Payout

- 8 sene payout - July 2023

- 8 sene payout - July 2022

- 8 sene payout - July 2021

- 4 sene payout - July 2020

- 4 sene payout - January 2020

- 10 sene payout - June 2019

- 10 sene payout - June 2018

- 9 sene payout - June 2017

- 9 sene payout - June 2016

- 10 sene payout - June 2015

- 9 sene payout - June 2014

- 8 sene payout - July 2013

There is a 3 months period after the end of every financial year for Unit-holders to either claim their dividend – or reinvest it. Otherwise after 3 months any dividends will be automatically reinvested to their respective accounts.

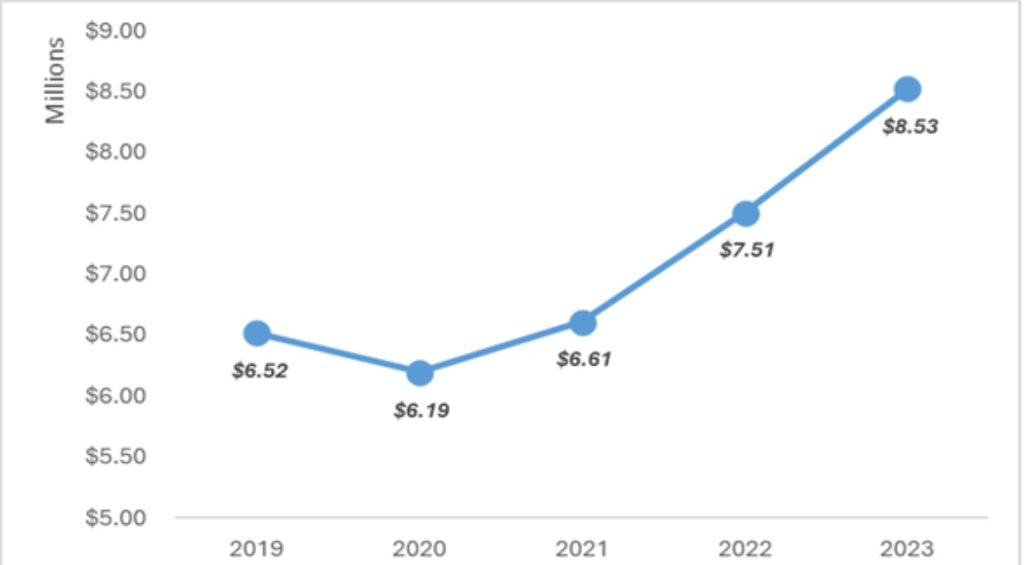

Total Returns

Benefits & Risks

- Affordability – The initial investment in UTOS can be as low as 25 units.

- Liquidity – As a Unit holder you can withdraw your funds invested in the Trust by simply selling back your units to the Manager.

- Access to a wide range of investments – Once you buy units in UTOS, you will also gain exposure to multiple investments.

- Tax-Free Dividend – Dividends paid through Unit holders are tax-free

- Capital Growth Opportunities – In addition to Dividends, units may increase in value, in line with the overall performance of the Trust’s investments. Therefore your initial investment can grow.

- Policy Risk – there is a risk that the current Government’s policy may change and future Governments may decline to transfer further shares in SOEs to UTOS.

- Withdrawal Risk – This is the risk of losing money because of a lower repurchase price (compared to the price at which you bought units) caused by fluctuations in the value of UTOS’s assets.

- Market Risk – This is the risk that unexpected economic or political conditions could have a negative impact on the returns of all investments in a particular market.

It is important to note that not all risks can be foreseen and past performance may not indicate full certainty of future results. Investing in UTOS carries risks as described above and Unit holders are advised to seek professional advice relevant to their personal circumstances before investing.